A Biased View of Palau Chamber Of Commerce

The smart Trick of Palau Chamber Of Commerce That Nobody is Talking About

Table of ContentsWhat Does Palau Chamber Of Commerce Mean?All About Palau Chamber Of CommerceGetting The Palau Chamber Of Commerce To WorkWhat Does Palau Chamber Of Commerce Do?Little Known Questions About Palau Chamber Of Commerce.Our Palau Chamber Of Commerce DiariesTop Guidelines Of Palau Chamber Of CommerceThe Facts About Palau Chamber Of Commerce Revealed

As a result, nonprofit crowdfunding is getting the eyeballs these days. It can be used for particular programs within the company or a general donation to the cause.During this step, you may intend to consider turning points that will certainly suggest a possibility to scale your nonprofit. Once you have actually run for a bit, it is necessary to take a while to consider concrete development goals. If you have not currently produced them during your preparation, produce a collection of essential performance indicators as well as milestones for your not-for-profit.

6 Simple Techniques For Palau Chamber Of Commerce

Without them, it will be difficult to review as well as track progression later on as you will certainly have absolutely nothing to gauge your results against as well as you will not know what 'effective' is to your not-for-profit. Resources on Starting a Nonprofit in different states in the US: Beginning a Not-for-profit Frequently Asked Questions 1. How a lot does it cost to begin a not-for-profit organization? You can start a not-for-profit company with an investment of $750 at a bare minimum and it can go as high as $2000.

7 Easy Facts About Palau Chamber Of Commerce Shown

With the 1023-EZ type, the handling time is commonly 2-3 weeks. Can you be an LLC and a nonprofit? LLC can exist as a nonprofit restricted obligation firm, nonetheless, it should be completely owned by a single tax-exempt nonprofit organization.

What is the difference between a foundation and a nonprofit? Foundations are generally funded by a household or a company entity, yet nonprofits are moneyed with their earnings and also fundraising. Structures normally take the cash they began with, spend it, and also after that disperse the cash made from those financial investments.

Examine This Report on Palau Chamber Of Commerce

Whereas, the additional money a nonprofit makes are made use of as operating costs to money the company's goal. However, this isn't necessarily true when it comes to a structure - Palau Chamber of Commerce. 6. Is it tough to start a nonprofit organization? A not-for-profit is an organization, however beginning it can be quite intense, requiring time, clarity, as well as money.

Although there are a number of steps to begin a nonprofit, the barriers to access are fairly couple of. 7. Do nonprofits pay tax obligations? Nonprofits are excluded from federal earnings tax obligations under section 501(C) of the internal revenue service. There are specific circumstances where they may require to make settlements. If your nonprofit gains any type of revenue from unrelated activities, it will owe earnings tax obligations on that quantity.

Indicators on Palau Chamber Of Commerce You Should Know

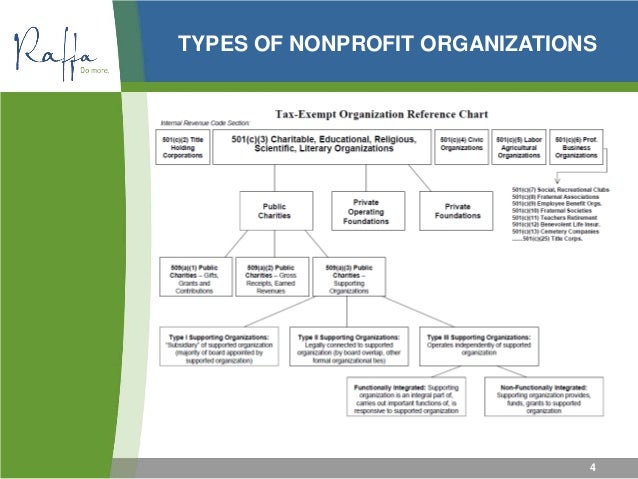

By much the most usual kind of nonprofits are Area 501(c)( 3) companies; (Area 501(c)( 3) is the component of the tax obligation code that licenses such nonprofits). These are nonprofits whose objective is charitable, religious, educational, or scientific.

The Main Principles Of Palau Chamber Of Commerce

The bottom line is that personal structures get much even worse tax obligation therapy than public pop over here charities. The major distinction in between private structures and also public charities is where they obtain their financial backing. A private structure is typically controlled by a specific, family members, or company, and obtains a lot of its income from a couple of contributors as well as investments-- an example is the Expense and Melinda Gates Structure.

Getting The Palau Chamber Of Commerce To Work

This is why the tax obligation legislation is so challenging on them. A lot of foundations just provide cash to other nonprofits. Nonetheless, somecalled "running foundations"run their own programs. As a sensible issue, you need at the very least $1 million to start a personal foundation; or else, it's not worth the trouble and also cost. It's not surprising, after that, that an exclusive foundation has actually been referred to as a large body of money bordered by people that desire some of it.

Various other nonprofits are not so fortunate. The IRS initially presumes that they are personal structures. Nonetheless, a brand-new 501(c)( 3) organization will be classified as a public charity (not a private foundation) when it gets tax-exempt standing if it can reveal that it sensibly can be expected to be publicly supported.

The smart Trick of Palau Chamber Of Commerce That Nobody is Talking About

If the IRS classifies the nonprofit as a public charity, it maintains this standing for its very first five years, despite the general public assistance it actually obtains throughout this time. Palau Chamber of Commerce. Starting with the not-for-profit's sixth tax obligation year, it should reveal that it meets the general public support examination, which is based upon the assistance it receives throughout the present year as well as previous four years.

If a not-for-profit passes the examination, the IRS will certainly continue to monitor its public charity standing after the first five years by needing that a finished Schedule A be submitted annually. Palau Chamber of Commerce. Discover more regarding your nonprofit's tax obligation status with Nolo's publication, Every Nonprofit's Tax Overview.